Unleash Financial Confidence: Discoveries With Layni Carver

Layni Carver is the CEO of Carver Financial Services, a financial planning firm that specializes in helping women achieve their financial goals. She is a certified financial planner and a member of the National Association of Personal Financial Advisors (NAPFA). Layni has been featured in numerous publications, including Forbes, The Wall Street Journal, and Kiplinger's Personal Finance.

Layni is passionate about helping women take control of their finances. She believes that financial planning is not just about numbers, but also about empowering women to make informed decisions about their money. Layni's goal is to help women achieve their financial dreams, whether that means retiring early, buying a home, or starting a business.

Layni's approach to financial planning is holistic. She takes into account her clients' unique circumstances, goals, and values. She then develops a personalized financial plan that helps them reach their goals. Layni is also a strong advocate for financial literacy. She believes that everyone should have the knowledge and tools they need to make sound financial decisions.

- Emilio Osorio Born

- Aislinn Derbez Boyfriend

- Thomas Jaraczeski Verdict

- Is Dennis Padilla Related To Robin Padilla

- Paul Simon Net Worth

Layni Carver

Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in financial planning for women and has been featured in numerous publications, including Forbes, The Wall Street Journal, and Kiplinger's Personal Finance.

- Financial planning

- Women and finance

- Financial literacy

- Retirement planning

- Investment planning

- Estate planning

- Tax planning

- Insurance planning

- Education planning

Layni's approach to financial planning is holistic. She takes into account her clients' unique circumstances, goals, and values. She then develops a personalized financial plan that helps them reach their goals. Layni is also a strong advocate for financial literacy. She believes that everyone should have the knowledge and tools they need to make sound financial decisions.

Layni's work has helped countless women achieve their financial goals. She is a passionate advocate for women's financial empowerment and is committed to helping women take control of their finances.

- Dj Skee Net Worth

- Jackie Love Is Blind Trans

- Jia Tolentino Parents

- Im Not Acrobatic Lil Baby

- Tahj Mowry Wife

| Name | Layni Carver |

| Occupation | CEO, Carver Financial Services |

| Education | B.S. in Business Administration, University of California, Berkeley |

| Certifications | CFP (Certified Financial Planner) |

| Memberships | NAPFA (National Association of Personal Financial Advisors) |

Financial planning

Financial planning is the process of creating a roadmap to achieve your financial goals. It involves identifying your goals, assessing your current financial situation, and developing a plan to reach your goals. Financial planning can help you make informed decisions about your money, avoid financial pitfalls, and achieve financial security.

Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in financial planning for women and has been featured in numerous publications, including Forbes, The Wall Street Journal, and Kiplinger's Personal Finance. Layni is passionate about helping women take control of their finances and achieve their financial goals.

Layni's approach to financial planning is holistic. She takes into account her clients' unique circumstances, goals, and values. She then develops a personalized financial plan that helps them reach their goals. Layni is also a strong advocate for financial literacy. She believes that everyone should have the knowledge and tools they need to make sound financial decisions.

Financial planning is an important part of Layni Carver's work. She uses her expertise in financial planning to help her clients achieve their financial goals. Layni's clients benefit from her knowledge and experience, and they are able to make informed decisions about their money.

Women and finance

Women face unique challenges when it comes to finance. They are more likely to earn less than men, have less access to capital, and be responsible for more unpaid care work. This can make it difficult for women to save for retirement, invest for the future, and achieve their financial goals.

- Financial literacy: Women are less likely than men to be financially literate. This means that they may not have the knowledge and skills they need to make informed decisions about their money. Layni Carver is a strong advocate for financial literacy. She believes that everyone should have the knowledge and tools they need to make sound financial decisions. She offers a variety of resources on her website and blog to help women improve their financial literacy.

- Investment planning: Women are less likely than men to invest their money. This can be due to a lack of knowledge, confidence, or access to capital. Layni Carver encourages women to invest their money as early as possible. She believes that investing is one of the best ways to grow your wealth and achieve your financial goals. She offers a variety of investment planning services to help women get started with investing.

- Retirement planning: Women are more likely to live longer than men. This means that they need to save more for retirement. Layni Carver helps women develop retirement plans that will help them achieve their retirement goals. She takes into account their unique circumstances, goals, and values when developing retirement plans.

- Estate planning: Women are more likely to be caregivers for their children and aging parents. This can make it difficult for them to plan for their own future. Layni Carver helps women develop estate plans that will protect their assets and ensure that their wishes are carried out.

Layni Carver is a leading expert in financial planning for women. She is passionate about helping women take control of their finances and achieve their financial goals. Her work has helped countless women achieve financial security and peace of mind.

Financial literacy

Financial literacy is the ability to understand and manage your personal finances. It includes budgeting, saving, investing, and planning for retirement. Financial literacy is important for everyone, but it is especially important for women. Women are more likely to live longer than men, and they are more likely to be responsible for caring for children and aging parents. This can make it difficult for women to save for retirement and achieve their financial goals.

Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in financial planning for women. Layni is passionate about helping women take control of their finances and achieve their financial goals. She believes that financial literacy is essential for women's financial empowerment.

Layni offers a variety of resources on her website and blog to help women improve their financial literacy. She also offers financial planning services to help women develop personalized financial plans that meet their unique needs and goals.

Financial literacy is a key component of Layni Carver's work. She believes that everyone should have the knowledge and tools they need to make sound financial decisions. Layni's work has helped countless women achieve financial security and peace of mind.

Retirement planning

Retirement planning is the process of creating a roadmap to achieve your financial goals in retirement. It involves identifying your goals, assessing your current financial situation, and developing a plan to reach your goals. Retirement planning can help you make informed decisions about your money, avoid financial pitfalls, and achieve financial security in retirement.

Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in financial planning for women. Layni is passionate about helping women take control of their finances and achieve their financial goals, including retirement planning.

Layni's approach to retirement planning is holistic. She takes into account her clients' unique circumstances, goals, and values. She then develops a personalized retirement plan that helps them reach their goals. Layni also considers factors such as Social Security benefits, Medicare, and long-term care costs when developing retirement plans.

Layni's work has helped countless women achieve financial security in retirement. She is a strong advocate for retirement planning and believes that everyone should have a plan in place to ensure a secure and comfortable retirement.

Investment planning

Investment planning is a crucial aspect of financial planning that involves making decisions about how to allocate your money to achieve your financial goals. Layni Carver, a certified financial planner and the CEO of Carver Financial Services, is a leading expert in investment planning for women.

- Asset allocation: Asset allocation is the process of dividing your investment portfolio into different asset classes, such as stocks, bonds, and cash. Layni helps her clients determine the right asset allocation for their individual needs and goals. She considers factors such as their risk tolerance, time horizon, and investment objectives.

- Diversification: Diversification is an investment strategy that helps to reduce risk. Layni helps her clients diversify their portfolios by investing in a variety of asset classes and investments. This helps to reduce the risk that they will lose money if one investment performs poorly.

- Investment selection: Layni helps her clients select investments that are appropriate for their individual needs and goals. She considers factors such as the investment's risk, return, and liquidity. She also considers the client's tax situation and investment horizon.

- Investment monitoring: Layni monitors her clients' investments on a regular basis. She makes adjustments to the portfolio as needed to ensure that it remains aligned with the client's goals and risk tolerance.

Layni's investment planning services have helped countless women achieve their financial goals. She is a strong advocate for women's financial empowerment and believes that everyone should have access to quality investment advice.

Estate planning

Estate planning is the process of creating a plan for the distribution of your assets after your death. It involves creating a will, trust, and other legal documents that will ensure that your wishes are carried out after you are gone.

Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in estate planning for women. Layni is passionate about helping women take control of their finances and achieve their financial goals, including estate planning.

- Wills: A will is a legal document that states how you want your assets to be distributed after your death. Layni can help you create a will that meets your specific needs and goals.

- Trusts: A trust is a legal entity that can be used to hold and manage your assets. Trusts can be used to avoid probate, reduce estate taxes, and protect your assets from creditors.

- Powers of attorney: A power of attorney is a legal document that gives someone else the authority to make decisions on your behalf. Layni can help you create a power of attorney that will ensure that your wishes are carried out if you become incapacitated.

Layni's estate planning services have helped countless women achieve peace of mind. She is a strong advocate for women's financial empowerment and believes that everyone should have an estate plan in place.

Tax planning

Tax planning is an important part of financial planning. It involves taking steps to reduce your tax liability and maximize your after-tax income. Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in tax planning for women. Layni believes that everyone should have a tax plan in place to help them save money on taxes.

There are many different tax planning strategies that Layni can help you implement. These strategies can help you reduce your taxable income, increase your deductions and credits, and avoid penalties. Layni can also help you plan for major life events, such as retirement and selling a business, to minimize your tax liability.

Tax planning is an essential part of financial planning. By working with a qualified financial planner, you can develop a tax plan that will help you save money on taxes and achieve your financial goals.

Insurance planning

Insurance planning is an important part of financial planning. It involves identifying your insurance needs and developing a plan to meet those needs. Layni Carver is a certified financial planner and the CEO of Carver Financial Services. She is a leading expert in insurance planning for women. Layni believes that everyone should have an insurance plan in place to protect themselves and their loved ones from financial hardship.

- Life insurance: Life insurance provides financial protection for your loved ones in the event of your death. Layni can help you determine the right amount of life insurance coverage for your needs. She can also help you choose the right type of life insurance policy.

- Health insurance: Health insurance helps you pay for medical expenses. Layni can help you find the right health insurance plan for your needs. She can also help you understand your health insurance policy.

- Disability insurance: Disability insurance provides income protection if you are unable to work due to a disability. Layni can help you determine the right amount of disability insurance coverage for your needs. She can also help you choose the right type of disability insurance policy.

- Long-term care insurance: Long-term care insurance helps you pay for the costs of long-term care, such as nursing home care or assisted living. Layni can help you determine if you need long-term care insurance. She can also help you choose the right type of long-term care insurance policy.

Insurance planning is an essential part of financial planning. By working with a qualified financial planner, you can develop an insurance plan that will protect you and your loved ones from financial hardship.

Education planning

Education planning is the process of creating a roadmap to achieve your educational goals. It involves identifying your goals, assessing your current financial situation, and developing a plan to reach your goals. Education planning can help you make informed decisions about your education, avoid financial pitfalls, and achieve your educational dreams.

- College savings plans: College savings plans are a great way to save for the future cost of college. Layni Carver can help you choose the right college savings plan for your needs. She can also help you develop a savings plan that will help you reach your college savings goals.

- Financial aid: Financial aid can help you pay for college. Layni Carver can help you find and apply for financial aid. She can also help you understand the different types of financial aid available.

- Scholarships: Scholarships are a great way to reduce the cost of college. Layni Carver can help you find and apply for scholarships. She can also help you write a scholarship essay that will make you stand out from the competition.

- Student loans: Student loans can be a helpful way to pay for college. Layni Carver can help you find and apply for student loans. She can also help you understand the different types of student loans available.

Education planning is an important part of Layni Carver's work. She believes that everyone should have the opportunity to get a good education. Layni's work has helped countless students achieve their educational goals. She is a strong advocate for education and believes that everyone should have access to quality education.

Layni Carver FAQs

This section provides answers to frequently asked questions (FAQs) related to financial planning for women, as addressed by Layni Carver, a certified financial planner and CEO of Carver Financial Services.

Question 1: What are the most common financial challenges that women face?

Answer: According to Layni Carver, women often face unique challenges in finance due to factors like the gender pay gap, career interruptions for caregiving, and longer life expectancies. These factors can impact their earning potential, savings, and retirement planning.

Question 2: How can women overcome these financial challenges?

Answer: Layni Carver emphasizes the importance of financial literacy and planning as key strategies for women to address these challenges. By gaining knowledge about personal finance, investing, and retirement planning, women can make informed decisions and take control of their financial futures.

Question 3: What are the essential elements of a sound financial plan for women?

Answer: Layni Carver suggests that a comprehensive financial plan should consider factors such as income and expenses, savings and investments, retirement goals, insurance needs, and estate planning. It should also align with individual circumstances, values, and long-term objectives.

Question 4: How can women prepare for retirement effectively?

Answer: Layni Carver highlights the significance of starting retirement planning early and consistently contributing to retirement accounts. Women should consider factors like their desired retirement lifestyle, estimated expenses, and potential sources of income during retirement.

Question 5: What are the key investment strategies that women should consider?

Answer: Layni Carver advises women to adopt a diversified investment portfolio that aligns with their risk tolerance and financial goals. This may include a mix of stocks, bonds, and other asset classes. Regular portfolio reviews and adjustments are also recommended.

Question 6: How can women protect their financial interests in the event of unexpected life events?

Answer: Layni Carver emphasizes the importance of having adequate insurance coverage, such as life insurance, health insurance, and disability insurance. These policies can provide financial protection and peace of mind in case of unforeseen circumstances.

Summary: Layni Carver's expertise and guidance can empower women to navigate financial challenges and achieve their financial goals. By prioritizing financial literacy, planning, and seeking professional advice when needed, women can build a secure financial future for themselves and their families.

Transition to the next article section: For further insights and personalized financial planning strategies, consider consulting with a qualified financial advisor who can provide tailored advice based on your specific circumstances and objectives.

Financial Planning Tips for Women by Layni Carver

Layni Carver, a renowned financial expert, provides these essential tips to help women make informed financial decisions and achieve their financial goals:

Tip 1: Prioritize Financial Literacy

Gain knowledge about personal finance, investing, and retirement planning. Understand your financial situation, set realistic goals, and make informed decisions about your money.

Tip 2: Create a Comprehensive Financial Plan

Develop a plan that outlines your income, expenses, savings, investments, retirement goals, insurance needs, and estate planning. Regularly review and adjust the plan as your circumstances and goals evolve.

Tip 3: Start Saving and Investing Early

Begin saving and investing as early as possible to take advantage of compound interest and maximize your returns. Diversify your investments and consider your risk tolerance when making investment decisions.

Tip 4: Plan for Retirement Strategically

Determine your desired retirement lifestyle and estimate your expenses. Contribute consistently to retirement accounts, such as 401(k)s and IRAs. Explore catch-up contributions if eligible to maximize your savings.

Tip 5: Seek Professional Advice

Consider consulting with a qualified financial advisor to receive personalized guidance based on your unique circumstances and financial goals. A professional can help you navigate complex financial decisions and optimize your financial strategy.

Tip 6: Stay Informed and Adaptable

Keep yourself updated on financial news and trends. Be prepared to adjust your financial plan as needed in response to changing economic conditions or life events.

Tip 7: Be Confident and Empowered

Believe in your ability to manage your finances effectively. Don't be afraid to ask questions, seek knowledge, and make informed decisions. Financial empowerment is crucial for women's financial success.

Summary: By following these tips, women can take control of their financial futures and achieve their financial goals. Remember, financial planning is an ongoing process that requires regular monitoring and adjustments. With the right strategies and support, women can build a secure financial foundation for themselves and their families.

Conclusion

Layni Carver's expertise and guidance empower women to navigate financial challenges and achieve their financial goals. Her emphasis on financial literacy, planning, and seeking professional advice when needed provides a roadmap for women to build a secure financial future for themselves and their families.

By embracing these principles and actively managing their finances, women can overcome the unique challenges they face and achieve financial empowerment. Layni Carver's work serves as a catalyst for change, inspiring women to take control of their financial lives and secure their long-term financial well-being.

- How Much Is Woody Allen Worth

- Vin Disel Race

- How Much Do Big Brother Jury Members Get Paid

- Wentworth Miller Spouse

- Mike Wolfe Legal Issues

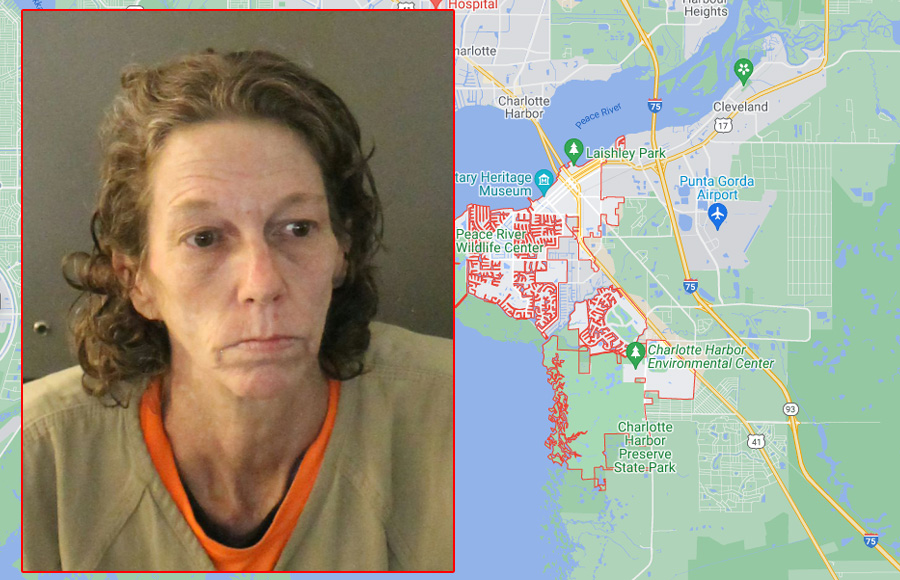

Punta Gorda woman faces charges for shooting at boyfriend, barricading self

Charlotte County Suspect barricaded inside home after firing at boyfriend