Finding Your Way Out: Essential Debt Advice For A Brighter Financial Future, Even When Looking For Mike Wolfe

When financial obligations feel heavy, it's very natural to look for help. Many people search for specific guidance, perhaps even looking for "debt advice mike wolfe," hoping to find that one person or resource that can really make a difference. The truth is, getting a handle on your money matters starts with understanding what debt is, how it works, and what options you have. This article aims to shed some light on those important points, offering practical steps you can take to move towards a more secure financial standing.

Debt, in its simplest form, is money you owe to someone else. It's a financial promise, a commitment to pay back what you've borrowed or what you've otherwise held onto from another party, which is that creditor. This concept, so it's almost, shows up in many parts of our lives, from small everyday purchases to much bigger things like buying a home. Knowing what debt is and how it functions is the very first step in taking charge of your financial situation.

Whether you are just starting to think about your financial obligations or you feel quite overwhelmed by them, finding solid advice is key. While you might be looking for "debt advice mike wolfe" specifically, the principles of smart debt management are often universal. We will explore various kinds of debt and suggest ways to manage them, giving you a clearer path forward.

- How Old Is Amanda Strachan

- Courtney Nikkiah Haywood

- Frank Fritz Mike Wolfe House

- Emilio Osorio Born

- Thomas Jaraczeski Verdict

Table of Contents

- What Is Debt, Anyway?

- Understanding Debt Types: Good Versus Bad

- Recognizing When You Have Too Much Debt

- Practical Steps for Dealing with Debt

- Finding Support and Solutions

- Frequently Asked Questions About Debt

What Is Debt, Anyway?

Debt, in a very straightforward way, is a financial obligation that you must repay. It's money you borrowed and, according to the Consumer Financial Protection Bureau, you must pay it back. This simple idea, you know, really forms the basis of many financial arrangements we have in the modern world. It could be a large sum of money borrowed for a major purchase, like a house or a car, and then repaid over a set period.

- Is Ben Chan Gay

- Ivy Niles

- Daniel Craig First Wife

- Is Dennis Padilla Related To Robin Padilla

- Korra Obidi Net Worth

It's also an obligation that needs one party, often called the debtor, to pay money borrowed or otherwise held from another party, the creditor. This relationship is quite fundamental to how our economic system works. Sometimes, believe it or not, debt may even be owed by a sovereign state or a whole country, which is a big thought, isn't it?

The concept of owing money is a part of life for nearly everyone at some point. It's not always a bad thing, actually. For instance, borrowing money to buy a home or to get an education can be a way to build a better future. The main thing is to understand what you owe, to whom, and what the terms of repayment are. This clear picture helps you stay in control.

Understanding Debt Types: Good Versus Bad

Not all debts are created equal, which is an important point to grasp. Some debt can actually be helpful, while other kinds can cause a lot of trouble. It's money owed, yes, but some debt is better than others. Knowing the difference can really help you make smarter financial choices.

What's the Difference Between Good and Bad Debt?

Good debt, in a way, often helps you build credit or equity. This means it's usually an investment that could grow in value or improve your financial standing over time. For example, a mortgage to buy a home is often seen as good debt. Your home might go up in value, and you're building equity in an asset. Similarly, student loans, while a financial commitment, can be considered good debt because they invest in your education, which can lead to higher earning potential.

Bad debt, on the other hand, is typically for things that lose value quickly or don't provide a return. Credit card debt is a common example of bad debt. When you use a credit card for everyday purchases and carry a balance, you're paying high interest rates on things that might not be worth much anymore. This kind of debt doesn't build wealth; it actually drains it. Other examples might include loans for depreciating assets like certain consumer goods that you don't really need.

Common Types of Debt and Tips for Dealing with Each One

Here are the main types of debt you might encounter, and some ideas for how to approach them, so you can feel more in charge.

Credit Card Debt

This is often the most pressing kind of debt for many people, given its high interest rates. It's money you owe on plastic, basically. If you have a balance on your credit cards, it's usually a good idea to focus on paying down the card with the highest interest rate first. This strategy, sometimes called the "debt avalanche," saves you the most money over time. You could also look into balance transfers to a card with a lower introductory rate, if that's an option for you.

Mortgages

A mortgage is a loan used to buy property, like your home. It's a significant financial obligation, often repaid over many years. Since it's generally considered good debt, the focus here is often on making your payments consistently and on time to build equity. You might also consider refinancing if interest rates drop, which could lower your monthly payments, too.

Student Loans

These loans help pay for education, and they can be a big part of many people's financial lives. Repayment terms can vary a lot, and there are often options for income-driven repayment plans or deferment if you're facing hardship. It's smart to explore these possibilities if you're struggling to make payments.

Auto Loans

A car loan helps you buy a vehicle. Cars tend to lose value over time, so this debt is a bit of a mix. It's important to make sure the car you buy is affordable and that the loan terms are manageable. Overpaying for a car can lead to being "upside down" on your loan, meaning you owe more than the car is worth, which is not ideal.

Personal Loans

These are unsecured loans that you can use for various purposes. They often have fixed interest rates and repayment periods, which can make them more predictable than credit card debt. Sometimes, a personal loan can be a good way to consolidate higher-interest debts into one simpler payment.

Recognizing When You Have Too Much Debt

At debt.com, they know debt and the solutions you need to get out of it. They also talk about how to tell if you have too much debt. This is a pretty important question for many people. It's not just about the total amount you owe, but how that amount affects your daily life and your ability to meet other financial goals.

One sign might be if you're only making the minimum payments on your credit cards each month. If you're doing that, it means you're barely touching the principal amount, and most of your payment is going to interest. This can make it feel like you're on a treadmill, running hard but not really getting anywhere.

Another indicator is if you're using credit to pay for necessities like groceries or utilities. This suggests that your income isn't quite covering your basic living expenses, and you're relying on borrowed money to fill the gap. That's a clear signal that something needs to change, you know?

Feeling stressed, anxious, or losing sleep because of your financial obligations is also a big sign. Debt can take a real toll on your well-being. If you find yourself constantly worrying about money or avoiding looking at your bills, it's a good time to seek some help.

Practical Steps for Dealing with Debt

If you can’t pay back your debt, there are things you can do to help yourself. It's not a hopeless situation, by any means. Taking action, even small steps, can make a big difference over time.

Create a Budget

The very first step is to get a clear picture of your income and expenses. This is basically your financial map. Write down everything you earn and everything you spend for a month or two. You might be surprised where your money is actually going. Once you see it all laid out, you can find areas where you can cut back, which can free up more money to put towards your debts. This helps you get a real sense of control.

Prioritize Your Debts

Once you know how much you can put towards debt, decide which ones to tackle first. As mentioned, the "debt avalanche" method focuses on paying down the highest interest rate debt first. Another popular approach is the "debt snowball," where you pay off the smallest debt first to gain momentum and motivation. Choose the method that feels right for you and helps you stick with it.

Negotiate with Creditors

Sometimes, if you're really struggling, it might be possible to talk to your creditors. They might be willing to work with you on a payment plan, lower your interest rate, or even settle for a smaller amount than you owe. It's worth a try, especially if you're honest about your situation. You might be able to find a solution that helps both sides.

Consider Debt Consolidation

If you have multiple debts, especially high-interest ones, consolidating them into a single loan with a lower interest rate can simplify your payments and potentially save you money. This could be a personal loan or a balance transfer. Just be careful to understand all the terms and fees involved, you know, to make sure it's actually a good deal for you.

Seek Professional Debt Advice

Sometimes, the best thing you can do is talk to someone who understands these things really well. A reputable credit counseling agency can offer personalized advice and help you create a debt management plan. They can also negotiate with creditors on your behalf, which can take a lot of pressure off.

Finding Support and Solutions

When you're looking for help with financial obligations, finding the right kind of support is very important. While the search query "debt advice mike wolfe" suggests a desire for specific, trusted guidance, it's important to remember that general, sound financial principles are widely available and can come from many reputable sources. The information provided in "My text" does not contain biographical details about a specific "Mike Wolfe" who provides debt advice. Therefore, we cannot offer personal details or a biography of such an individual here. Instead, our focus is on the core principles of debt management that can help anyone, regardless of who they are looking for.

Organizations like Hartford Healthcare Senior Services, though focused on senior care, also highlight the importance of understanding financial obligations. While their main services are skilled nursing care and rehabilitation, they are part of a larger network that understands the need for clear information and support in various life areas. You can learn more about their locations at hhcseniorservices.org, which shows how big organizations often have many facets to their community support.

For instance, Southington Care Center, located at 45 Meriden Ave, Southington, CT 06489, provides exceptional skilled nursing care and rehabilitation services. They also offer outpatient therapy specialty programs, including speech therapy and lymphedema management. While this is not directly debt advice, it shows a commitment to comprehensive care, which often includes helping people manage their lives, including financial aspects. Similarly, Hartford Healthcare Healthcenter, Southington, at 462 Queen Street, Suite 101, Southington, CT 06489, and Hartford Healthcare Medical Group, 1000 East Main Street, Torrington, CT 06790, are part of this wider network.

The idea of support extends to volunteering opportunities, too. Southington Care Center, Jerome Home at 975 Corbin Ave, New Britain, CT 06052, and Jefferson House at 1 John H. Stewart Drive, Newington, CT 06111, all offer ways for people to get involved in their community. This kind of community involvement, you know, often helps people feel more connected and can even indirectly assist with life's stresses, including financial ones.

Remember, debt is a part of life, but there are many types of debt, and there are always ways to learn more about what debt is and how it works. If you are feeling overwhelmed, remember that you are not alone, and there are resources out there to help you find relief. Learning more about financial wellness on our site can be a good starting point, and you can also find specific advice on managing credit card balances here.

Frequently Asked Questions About Debt

What exactly is debt, and why does it matter?

Debt is basically money you owe to someone or something. It's money that you borrowed and, you know, must pay back, as the Consumer Financial Protection Bureau explains. It matters because it's a financial obligation that must be repaid. In the modern world, it can be a large sum borrowed for a major purchase, repaid over time, or even smaller amounts from credit cards. Understanding it helps you manage your financial health and avoid problems.

Are all types of debt the same, or are some better than others?

No, all debts are not created equal, which is quite important to know. Some debt is actually considered "good debt" because it builds credit or equity, like a mortgage or student loan. Other debt, like credit card debt with high interest rates, is generally considered "bad debt" because it doesn't really build value and can be very expensive. Knowing the difference helps you make smarter choices about borrowing money.

What can I do if I feel overwhelmed by my financial obligations?

If you can’t pay back your debt, there are definitely things you can do to help yourself. The first step is often to understand how much you owe and to whom. Then, you can look into creating a budget, prioritizing your debts, or even talking to your creditors to see if you can work out a payment plan. Sometimes, finding professional help from a credit counseling agency can also be a really good option to find relief.

- Faye Dunaway Spouse

- Harry Bring Death

- Bobcat Screaming Like A Woman

- Catharine Daddario Age

- Thomas Jaraczeski Verdict

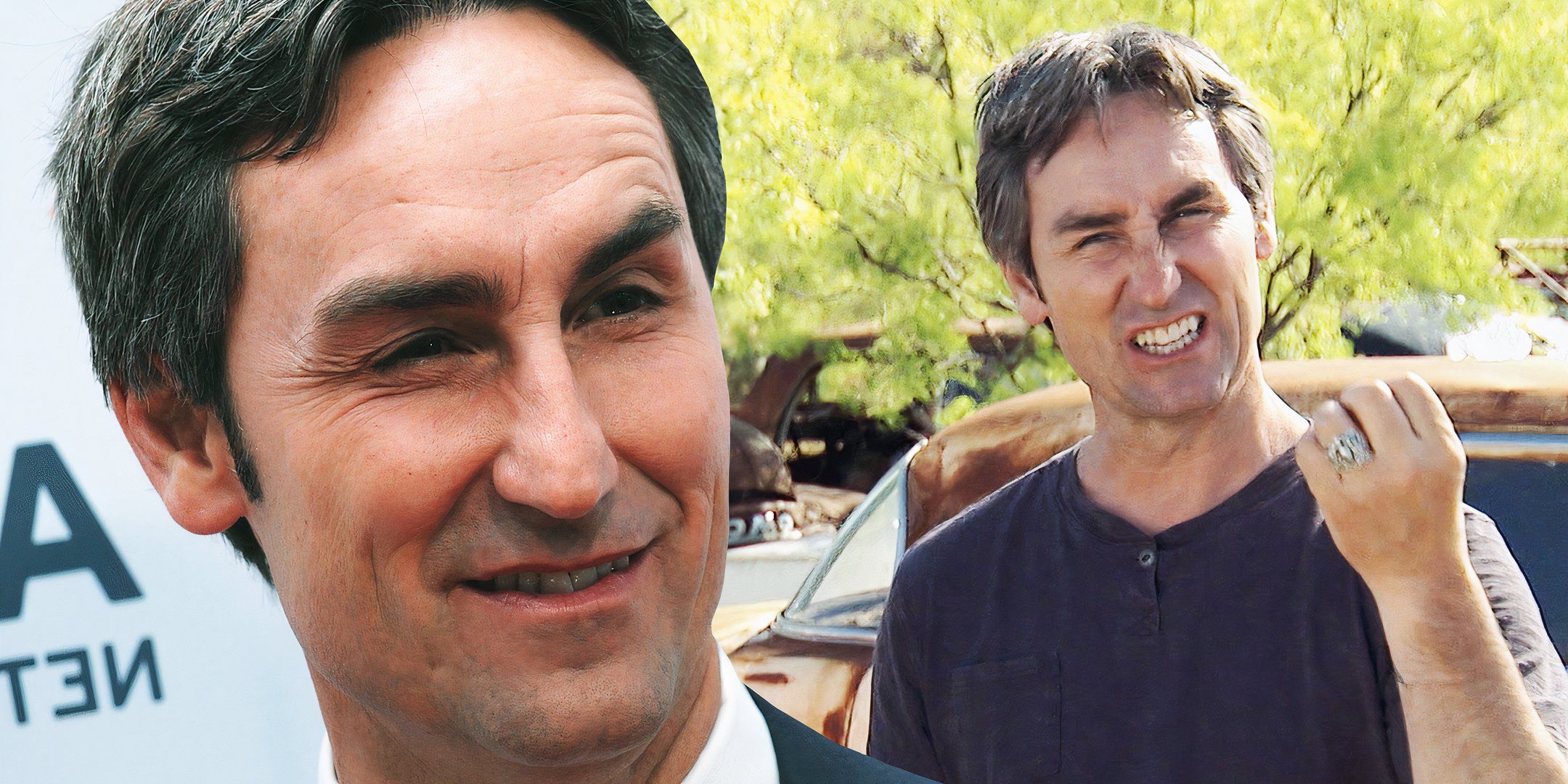

American Pickers' Mike Wolfe generously donates $10K to tornado relief

Why Did Danielle Leave 'American Pickers'?

Danielle Colby shares personal updates and Mike Wolfe's advice amid